Wise (formerly TransferWise) Review

John Thorstensen

John is a recognized world expert in investing. He has tested dozens of investment clubs, communities and investment research services. His research has been featured on Bloomberg, Business Insider, The New York Times, Wall Street Journal, CNet and more.

🕒 Short on time?

The most used for business worldwide is Wise, best known for having one of the lowest currency conversion fees, and multi-currency accounts. Opening an account requires a one-off fee of £16 ($20) to start receiving transfers and give you extra banking details.

By doing this, you’ll have access to the best features of US banking, the lowest fees on the market, and transfer your money with the best currency conversion rate.

Sign-up now and access the best conversion rates!

- Fee-free sign-up!

(11,948 user reviews)

Content

Wise Review

Wise (formerly TransferWise) is a fintech company founded in 2011 and headquartered in London. The banking service offers access to international business account details as non-residents of a country.

Wise revolutionized the financial industry with a handy multi-currency account, also offering extremely attractive money exchange rates and less bureaucracy.

The fintech company offers the main features to manage a business's finances and operate internationally.

Recently the company decided to change its name from TransferWise to Wise, in order to better summarize the range of services provided, which goes far beyond international transfers at low rates. Although the name is different, the fintech still offers the same services as before.

Wise Bank Pros & Cons

Pros

- Supports 50+ currencies

- Associated business debit card

- Extremely low fees for currency exchange

- £200 of free cash withdrawals

- 100% online account opening

- Internet-based banking services

- No monthly fees

Cons

- Don’t accept cash deposits

- $20, £16 or €20 one-off fee to start receiving money

- Debit card is not available in many countries

Wise at a glance

Companies that operate overseas need international business bank accounts. Rather than opening those accounts in traditional banks, entrepreneurs are opting for fintechs as they offer more benefits with fewer fees.

The most used for business worldwide is Wise, best known for having one of the lowest currency conversion fees, and multi-currency accounts.

Wise is ideal for self-employed, small, and large companies that deal with international markets and need different account details overseas. The fintech allows sending and receiving payment to 80+ countries.

Moreover, it allows you to create balances in many different currencies, which in practice means saving money that would be used for currency conversion in other banks.

| Feature | Details |

|---|---|

| Minimum Deposit | $0 |

| Monthly Fee | $0 |

| Overdraft Fee | $0 |

| Outgoing Transfer Fee | Fixed fee depending on the currency + Transfer rate for different currencies |

| Getting Account Details | $20, £16, €20 (one-time fee according to country currency) |

| Branches | 12 (across 11 countries) |

| ATM withdraw | $100, £200 or 200€ for FREE then 2% fee for withdrawals |

| Supported Currencies | British Pound, US Dollar, Euro, Canadian Dollar, Australian Dollar, Swiss Franc, New Zealand Dollar, Philippine Peso, Swedish Krona, Singapore Dollar, United Arab Emirates Dirham, Argentine Peso, Bangladeshi Taka, Botswana Pula, Bulgarian Lev, Chilean Peso, Chinese Yuan, Costa Rican Colón, Czech Koruna, Danish Krone, Egyptian Pound, Georgian Lari, Ghanaian Cedi, Hong Kong Dollar, Croatian Kuna, Hungarian Forint, Indonesian Rupiah, Israeli Shekel, Indian Rupee, Japanese Yen, Kenyan Shilling, South Korean Won, Sri Lankan Rupee, Moroccan Dirham, Mexican Peso, Malaysian Ringgit, Nigerian Naira, Norwegian Krone, Nepalese Rupee, Peruvian Sol, Polish Zloty, Pakistani Rupee, Romanian Leu, Russian Ruble, Thai Baht, Turkish Lira, Tanzanian Shilling, Ukrainian Hryvnia, Ugandan Shilling, Uruguayan Peso, Vietnamese Dong, West African CFA Franc, South African Rand, Zambian kwacha. |

Is Wise a bank?

Wise is not considered a bank since it has not secured a banking license - and hasn’t shown interest to have -, but it is authorized as an Electronic Money Institution (EMI).

The company also follows a strict set of rules by regulatory agencies in all countries it operates, like FCA in the UK and FinCen in the US. In addition, Wise has bank-level data security, ensuring safe navigation with end-to-end encryption.

Through strategic partnerships with top financial institutions, Wise enables users to have account details for other countries, like IBAN, wire number, and SWIFT code, which means that your business money will be also stored in different banks worldwide. For example, USD accounts have money safeguarded at JP Morgan Chase, while GBP accounts at Barclays.

All the accounts are managed entirely online through the app or the web browser. Wise business bank accounts are free to open, with no monthly or annual service fee.

However, a one-off payment of £16 ($20) is necessary to start receiving transfers and give you extra banking details. This one-off payment amount can be spent later.

Can I trust Wise?

In a nutshell: you can trust your company’s money to Wise. The fintech emerged as a solution to customers’ problems in traditional banks, like high exchange rates, lengthy overseas transactions and excessive bureaucracy.

Wise offers a customer-focused experience where services and fees are transparent to all users, making them understand where exactly every penny is being spent. Also, the company provides a high level of security and reliability, making customers feel protected by top-notch security protocols on the website and app.

All Wise clients need to go through 2-step login and verification procedures as preventive measures to access their accounts. Moreover, user’s funds are separate from Wise’s segregated accounts, meaning that your assets cannot be used by the fintech to conduct business operations. In practice, it means that your money is secured even if Wise is in financial trouble.

The Electronic Money Institution is strongly licensed in all the countries it offers its services. For example, in the United Kingdom, Wise is regulated by the FCA (Financial Conduct Authority) and HMRC (Her Majesty’s Revenue and Customs); in the United States it’s registered with the AUSTRAC (Financial Intelligence Unit) as a money remitter and it’s authorized by the FinCEN (Financial Crimes Enforcement Network); while in Australia, Wise is regulated by the ASIC (Australian Securities and Investments Commission).

The financial services company is totally safe to manage your business finances. Your assets will be secured with Wise and you will have a fully transparent account, allowing you to understand all your expenses. It’s noteworthy that Wise is highly rated at TrustPilot, being considered an excellence in banking service.

How to open an account

You can set up a business account in just a few minutes, and start benefiting from Wise services right after that. To start your account, you just need to click in “get a Wise Business account in minutes”, select the Business option, enter your personal data, and click to register. For the following steps, you’ll need to get verified with a photo ID, proof of address, and a photo of you holding your ID.

It’s also necessary to describe your business with the following documents:

- Business registration

- Company’s address

- Type of business

- Website and Social Media

- Personal data for all legal business owners

It can take up to 7 working days for Wise to verify all information you sent. Once accepted, you can order your business debit card.

What does it offer?

Wise is ideal for international business that deals with different currencies. The company offers local bank details to receive GBP, EUR, USD, AUD, NZD, HUF, RON, and SGD. Customers can also store 50+ different currencies in separate balances within their account, additionally, they benefit from the best exchange rates in the market. For more effective management of finances, Wise allows you to add your team to the business account. With admin permissions, they can make payments and manage the account; and as viewers, your team can have an overview of the account, download statements and receipts. In addition, the company also offers integrations with Xero for a seamless process to pay multiple bills.

The business bank account also includes a multi-currency free debit card. Additional physical cards can be ordered for $3 each to better manage the company’s expenses.

Wise Business also allows transactions and spending monitoring. In addition, account integrations make it easy to filter and manage transactions.

Languages

EN, DE, FR, ES, IT, PL, PT, BI, RU, RO, MA, CN

Conversion Rate Fee

$0.20 + ~0.3% for USD

Signup Fee

£16 ($20)

Reviews

Money Transfers

One of Wise’s most notable features is its easy, straightforward and extremely low-rate money transfer. Sending money with Wise is almost instantaneous, the transfer speed is one of the best (maybe even the fastest) on the market.

Wise supports transferring money from 43 countries and to 71 countries. More than 1000 routes are covered across 57 currencies, which means your money can travel through different countries in order to be delivered faster to the recipient.

You can send money overseas and it will probably arrive on the same day. The company charges a small amount per transfer, generally sitting at 0.4% depending on the currency, and a low fixed fee for any payments sent from Wise to another bank account. In the case of more than £100.000 (or equivalent in other currency) a month, you get a discount on transfer rates.

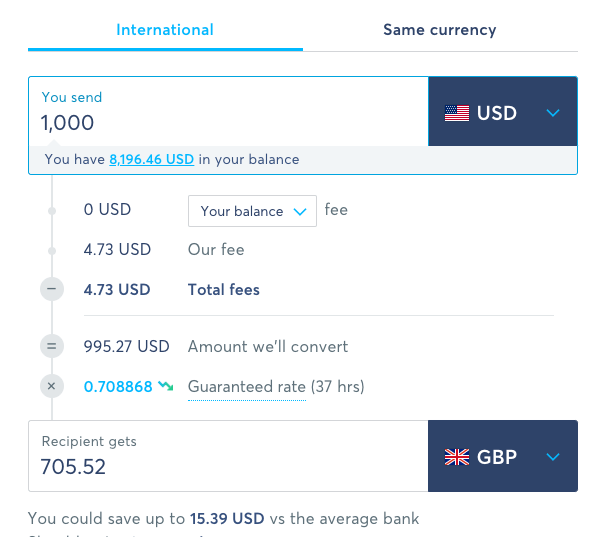

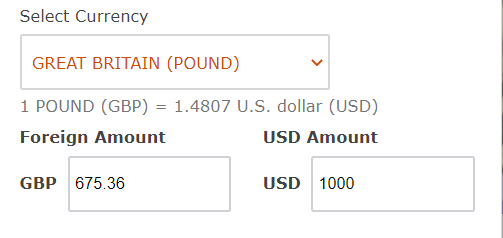

Let's say we use Wise to transfer 1000 USD from the United States to a UK bank account in GBP. The fintech charges a small fee of 4.73 USD for the currency exchange, which will leave 995.27 USD to be transferred, and a final amount of 705.52 GBP. The same transaction through a traditional bank, such as Well Fargo, would result in a final amount of 675.36 GBP. The difference of 30 GBP (approx. $42) can be yours when using Wise.

Usually, transfers are made by manual bank transfers. Some currencies also support transferring with debit or credit cards, Apple or Google Pay services, and using SOFORT, iDeal or Trustly.

Summary - Make the most of Wise

Most international and online companies want to expand their activities to the US due to the high consuming public and the benefits of making business in the world’s largest economy.

For better usage of banking services in the United States, it’s recommended to also open a business account in a national bank, so you can manage USD finances within the country.

Our suggestion is to combine Wise with Mercury business bank account, a US online banking whose opening process can be done online and free of bureaucracies.

By doing this, you’ll have access to the best features of US banking, instant virtual debit cards from Mercury, and fast money transfers with the lowest fees and conversion rates on the market by Wise.

Sign-up now and access the best conversion rates!

- Fee-free sign-up!

About the author

John Thorstensen

John is a recognized world expert in investing. He has tested dozens of investment clubs, communities and investment research services. His research has been featured on Bloomberg, Business Insider, The New York Times, Wall Street Journal, CNet and more.