Top 3 banks to open a US business account without a SSN

Colvin Smith

As an entrepreneur and member of numerous investment platforms and communities, I see how valuable financial research can be in the long run. It allows for better financial management and more accurate decisions.

Whether you’re trying to avoid steep currency conversion rates or ensuring your company’s presence in the US market, opening a bank account in the world’s largest economy can be extremely beneficial to your entity. Many banks allow non-citizens to open a business account within the country, each one with different procedures.

High-street banks usually require a personal visit to the branch. Some additional documents are also asked, such as SSN (Social Security number), EIN (Employer Identification Number), proof of address in the US, and a document proving your source of income, which can significantly lengthen and complicate the process, especially with the need of an SSN - only available for US citizens or residents.

Fortunately, neobanks and fintech companies have disrupted traditional banking systems, offering an easier way to open business bank accounts. Check out the top 3 digital banks to easily set up your business account without having to provide an SSN.

Free debit card

Open virtual cards

Main country presence

US, Asia, Oceania

US & Europe

US

Integrations

API & Xero

API & Xero

API, Xero, Quickbox, Zapier

Lowest fees possible

- No-fee sign-up!

- No-fee sign-up!

- No-fee sign-up!

- No-fee sign-up!

- No-fee sign-up!

- No-fee sign-up!

Content

Wise

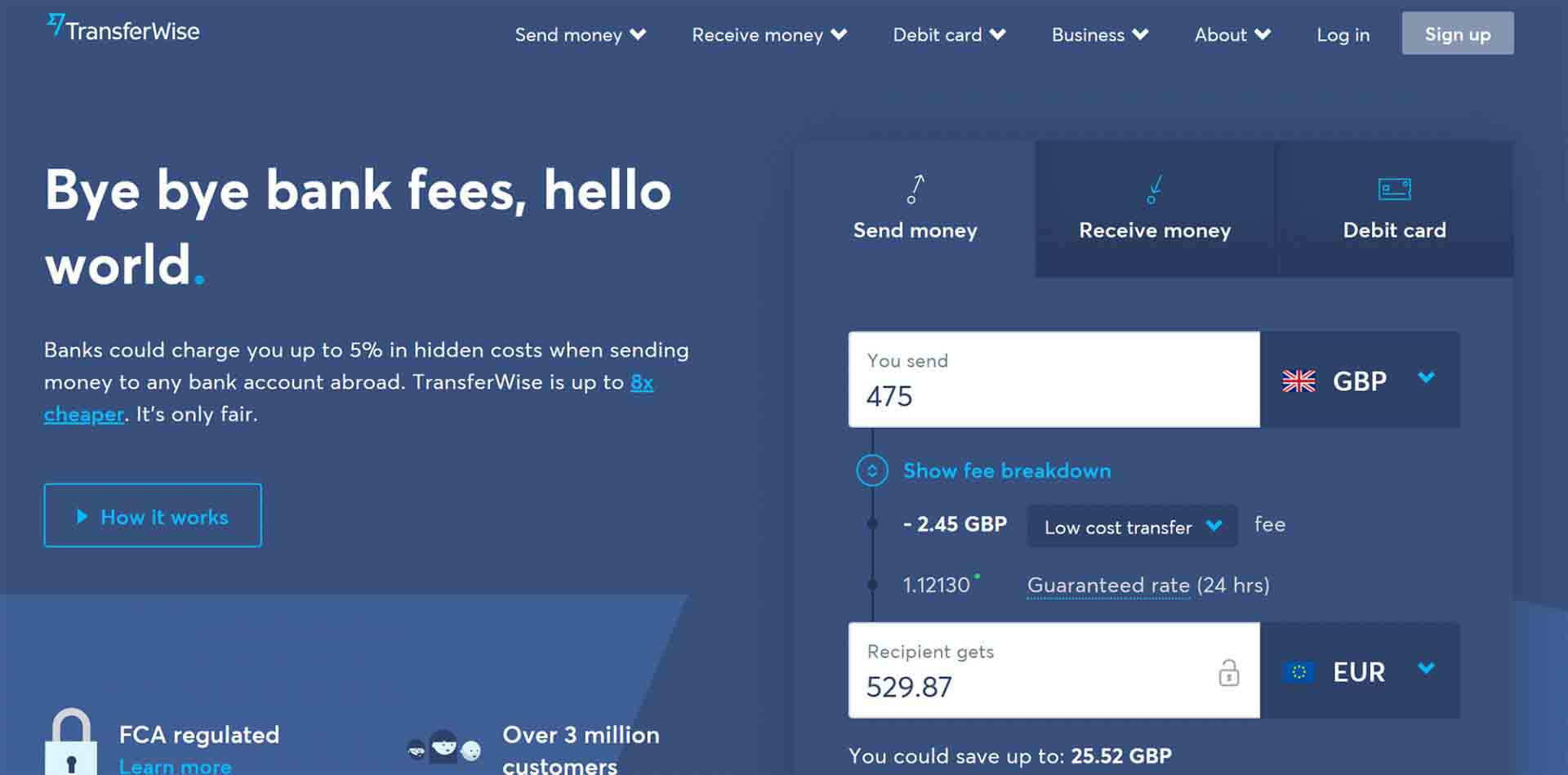

Wise is a fintech company that offers global banking services and supports over 50 currencies, which can be stored simultaneously in separate balances, with very competitive exchange fees. The account is entirely manageable online through the app or browser, with end-to-end encryption to ensure safe navigation on bank-level data security. It also works in compliance with the regulatory agencies of the countries in which it operates, for example, FinCen and FCA.

You can open an account online without having to prove your residency in the US. A proof of address from your home country, a photo of your ID, and a photo of yourself holding your ID will be enough to complete the process, which takes up to 7 days. On top of that, you will need to define your business by providing your company registration, your address, type of business, website and social media, and personal data of all legal owners.

Opening an account is completely free, without monthly or annual fees, it includes a free multi-currency debit card and only a one-off payment of £16 ($20) is necessary to start receiving transfers. Once done, you can benefit from the possibility of using account details for other countries, like IBAN, wire number, and SWIFT code, thanks to Wise’s partnerships with top financial institutions.

You will be charged a small amount per transfer (around 0.4%, depending on the currency), and a low fixed fee for any payments sent from Wise to another bank account. In the case of more than $100.000 a month, you will benefit from a discount on transfer rates. For withdrawals of up to £200, there are no fees, while for others, a 2% of the amount will be applied. Cash deposits, though, are not accepted.

You can open an account online without having to prove your residency in the US. A proof of address from your home country, a photo of your ID, and a photo of yourself holding your ID will be enough to complete the process, which takes up to 7 days. On top of that, you will need to define your business by providing your company registration, your address, type of business, website and social media, and personal data of all legal owners.

- Fee-free sign-up!

Mercury

Since its launch in 2019, Mercury has revolutionized traditional US banking systems, offering the possibility to open an account online, leaving behind the out-of-date procedures of traditional banking, like the need for non-residents to bring documents to the bank in person.

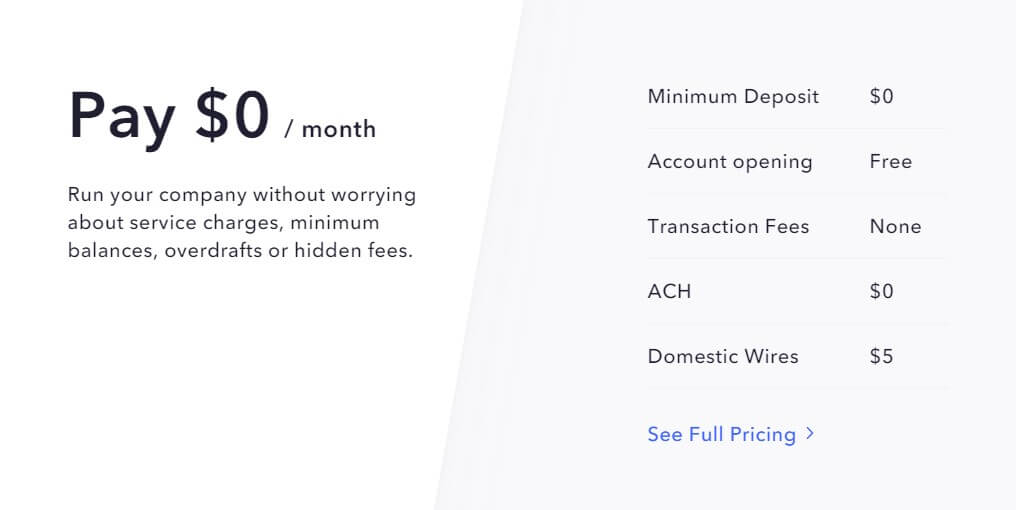

This neobank, built for startups with a presence in the US market, does not charge transaction or monthly fees, and does not require any minimum opening deposit. Even though it does not have local branches, it still provides banking services enhanced by Evolve Bank & Trust, as well as a solid security system, with FDIC insurance up to $250.000, heavily encrypted pages, and 2-factor-authentication.

Opening an account is fast and uncomplicated, as, in addition to an ID and the company formation documents, you only need to register your company in the US and provide the EIN (Employer Identification Number) verification letter - without the need of having an SSN or a business address registered in the US.

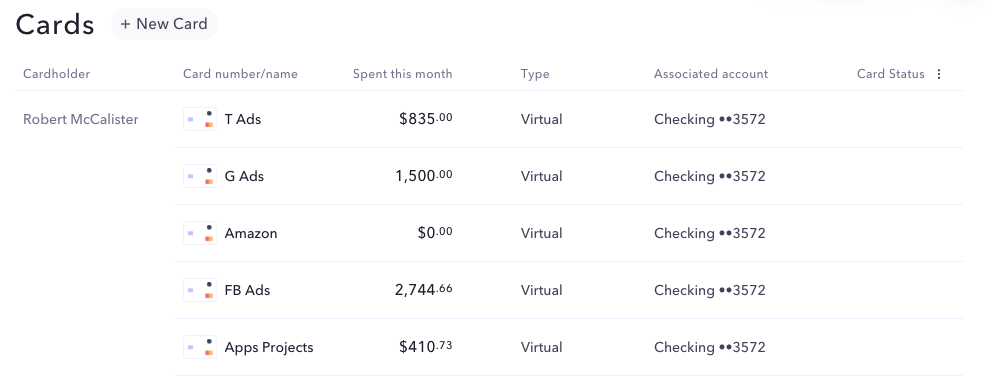

Once your account is ready, you will be able to manage your finances entirely online, through the website, or the iOS app. Additionally, you will receive a physical business debit card with the option to create up to 50 more virtual cards. This special feature will help you to categorize and track different expenses under the same account - also thanks to the possibility of creating a different name for each card.

The low rates are one of Mercury’s great advantages: you will not be charged monthly, overdraft or other hidden fees, and you will only have to pay $5 for domestic and $20 for international transactions.

If your account reaches over $250.000 in deposits, fees for domestic and international wire transfers will not be charged, as your account will be automatically upgraded to the “Tea Room”. This is an exclusive feature of Mercury, consisting of additional benefits like having the extra funds employed on low-risk investments in U.S. government securities, special partnership perks, and, yes - even free tea!

The financial responsibility can also be shared with other team members, thanks to the possibility of setting two different permission levels (Administrator or Bookkeeper). It’s also possible to create up to 14 sub-accounts each with its own individual information and virtual cards. Sending and depositing checks online is also possible with Mercury, moreover, this fintech offers integrations with QuickBooks, Xero and Zapier.

The low rates are one of Mercury’s great advantages: you will not be charged monthly, overdraft or other hidden fees, and you will only have to pay $5 for domestic and $20 for international transactions.

- No-fee sign-up!

Airwallex

Airwallex is a fintech that offers easy, fast, and secure business cross-borders transactions, in pace with the progress of fast-growing companies. It provides solid safety measures, like multiple layers of authentication and encrypted security, and works in compliance with the regulations of FCA in the UK, ASIC in Australia, FINTRAC in Canada, and Customs and Excise Department in Hong Kong.

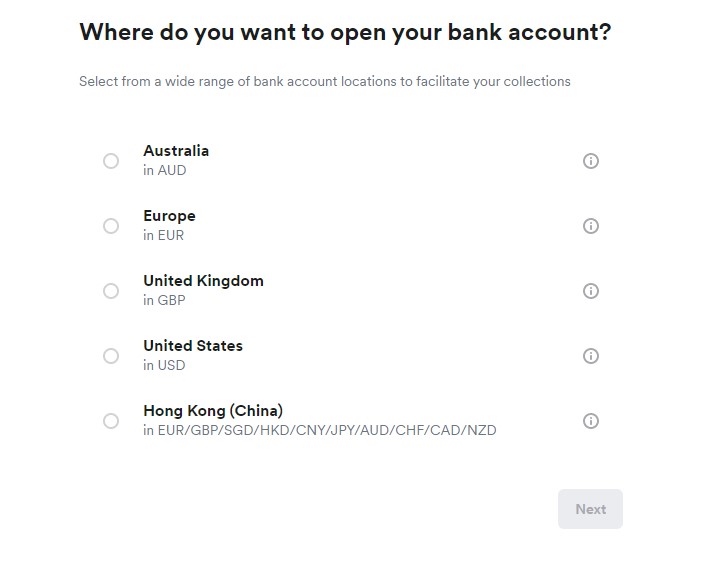

Built on auto-routing algorithms, designed to find the optimal route to make faster payments worldwide, this fintech has become one of the best options for corporations operating abroad, thanks to its partnership with banks around the world. This allows you to open free multi-currency virtual accounts with local bank details in the US, UK, Europe, Hong Kong, Japan, and Australia.

Airwallex supports over 50 currencies across more than 130 countries, with exchange rates that can be up to 90% cheaper than banks, depending on the transactions. A fixed fee based on the payment method and currency will be charged and, in some cases, also a conversion rate for foreign transactions (FX), which is a percentage on top of the exchange rates (0.3% - 0.6% above interbank rates).

Financial management is also enhanced by the possibility to add team members to collective accounts and by using API integration to allow automated payments. In addition, you will be able to have all your multi-currency transactions synchronized on one platform, due to Xero integration. You will also receive a borderless Visa debit card.

The simplified bureaucracy is one of the main advantages of Airwallex. Opening an account is quick and easy. You only need an email address, a phone number, the agreement to terms and conditions and your business name. No minimum deposit will be demanded and no fees will be charged when signing up.

- Fee-free registration

Summary - our verdict

In a nutshell, Wise is the fintech leader in multi-currency accounts at extremely low fees, Mercury in business bank accounts within the US, and Airwallex is leader in Asian markets. Foreign entrepreneurs can benefit from the three services at the same time and guarantee a strong commercial presence all over the world.

By using Wise, Mercury and Airwallex, you’ll be able to make and receive payments easily, convert to other currencies at the lowest exchange rates, make super-fast transactions, have business debit cards on hands, multiple online cards, and automate payments. All your business needs are solved with those three bank accounts.

About the author

Colvin Smith

As an entrepreneur and member of numerous investment platforms and communities, I see how valuable financial research can be in the long run. It allows for better financial management and more accurate decisions.