John is a recognized world expert in investing. He has tested dozens of investment clubs, communities and investment research services. His research has been featured on Bloomberg, Business Insider, The New York Times, Wall Street Journal, CNet and more.

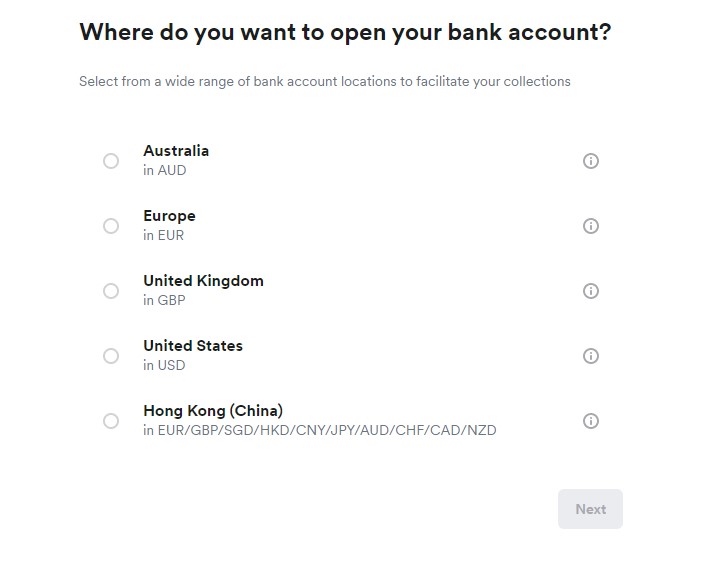

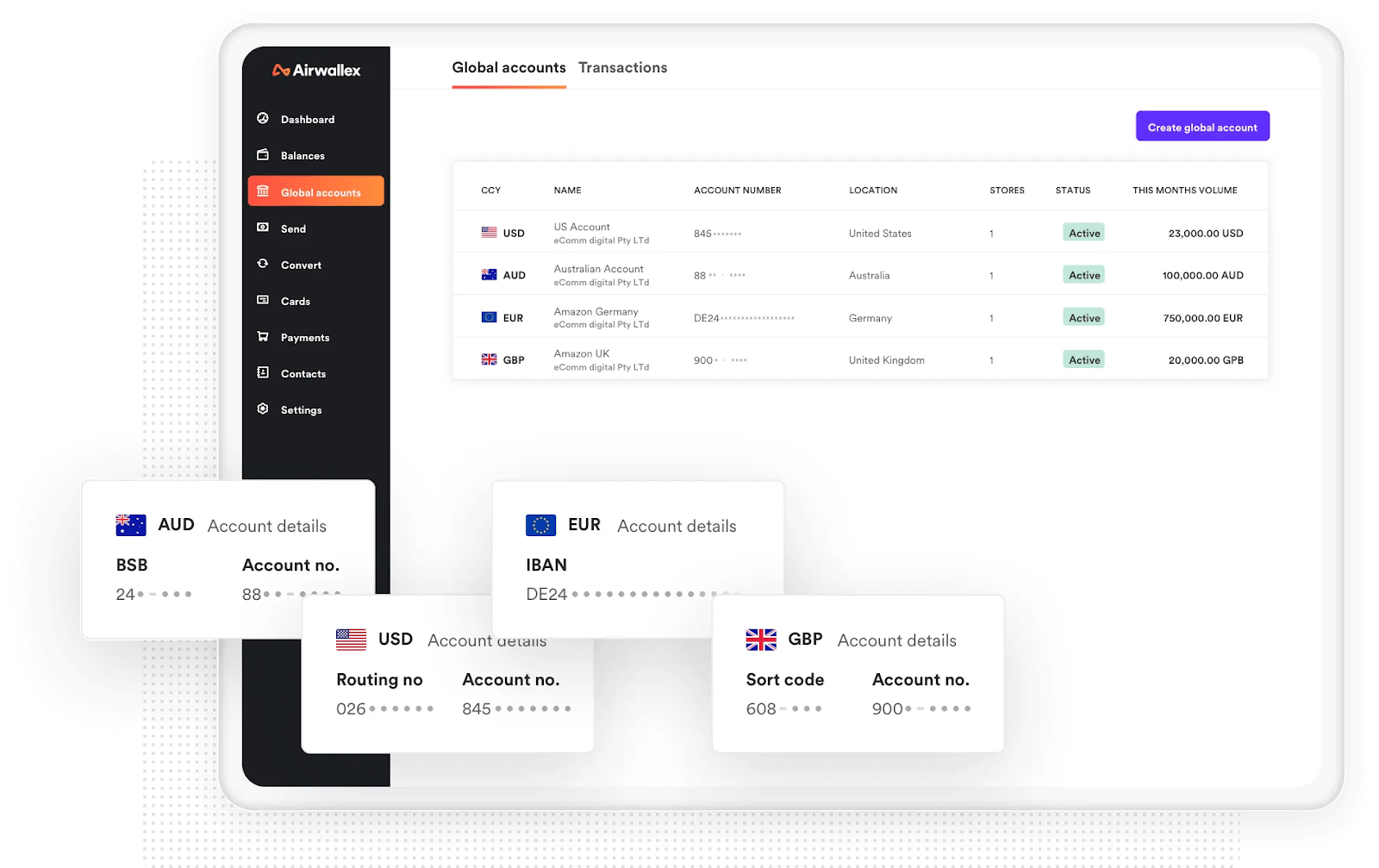

Opening an Airwallex business bank account allows you to have local bank details in the US, UK, Europe, Hong Kong, Japan and Australia. You can also hold funds in multiple currencies to eliminate unnecessary conversions.

Corporations can benefit from free virtual accounts and collective accounts, where it is possible to add team members to help manage the business finances. Airwallex offers a borderless Visa debit card that enables purchasing and paying from anywhere in the world.

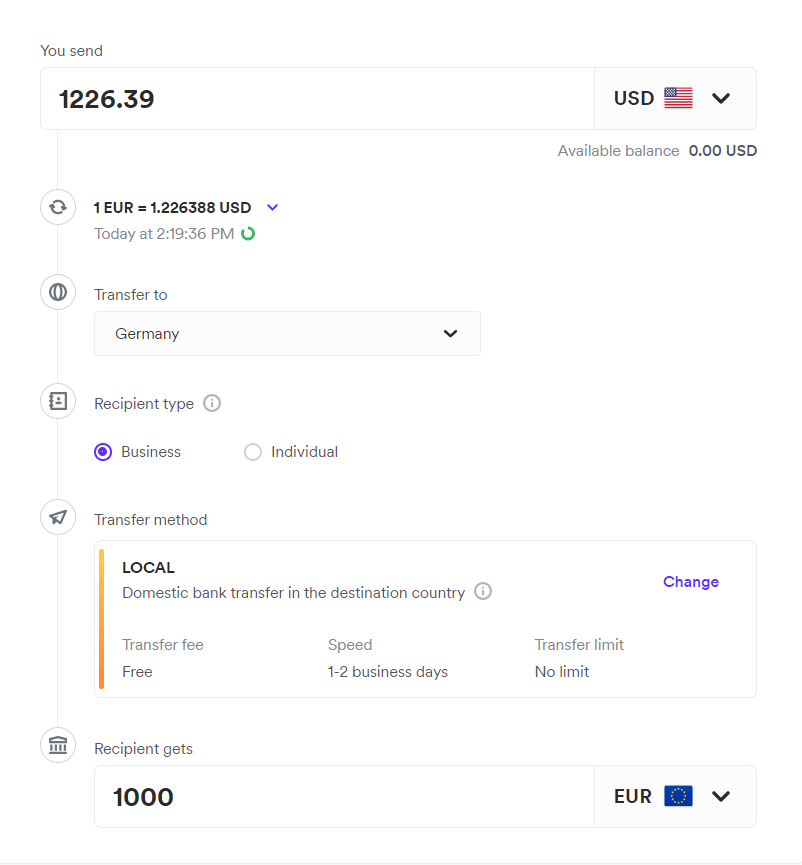

Airwallex stands out for offering bank-beating prices in international payments with some of the best exchange rates on the market, up to 90% cheaper than banks.

Sign-up now and get $20,000 fee-free conversions!

Airwallex is a global payments fintech founded in Melbourne in 2015. The company provides online financial services for cross-border businesses, which include multi-currency accounts, corporate debit cards, international money transfers, and an online platform to manage borderless payments in just a few clicks.

The fintech company is a world leader in innovation, competing with large established companies to solve business finances.

Fast-growing companies need a financial system that keeps pace with their progress. Traditional banks are becoming increasingly difficult to work with due to excess bureaucracy, high fees, and a slow pace to integrate new services. Fortunately, businesses can count on fintechs, like Airwallex, that streamline financial management and ensure that your money moves, no matter what time of the day.

Airwallex is a great option for small and large companies operating abroad. The fintech provides corporations with global accounts to collect payments in different currencies in more than 130 countries.

The company was built on auto-routing algorithms designed to find the optimal route to make faster payments worldwide.

| Feature | Details |

|---|---|

| Minimum Deposit | $0 |

| Exchange Rates | 0.3% - 0.6% above interbank rates |

| Monthly Fee | $0 |

| Non-local Currencies Payment Fee | $8 |

| Branches | 12 international offices |

| ATM withdraw | $0 |

| Supported Currencies | AUD, BDT, CAD, CHF, CNY, EUR, GBP, HKD, IDR, INR, JPY, KRW, LKR, MYR, NPR, NZD, PHP, PKR, SGD, THB, TRY, USD, VND |

Even though Airwallex provides most banking services, the fintech is not considered a bank, as it doesn’t have banking licenses. The company was created to supply a demand that most traditional banks fail to accomplish: easy, fast, and secure business cross-borders transactions.

To fulfill its mission, Airwallex has partnered with many banks around the world, enabling customers to have account details in other countries. This also means that your company’s money will be safeguarded in different banks.

Airwallex is safe to use and authorized as an Electronic Money Institution (EMI) for European customers. The company is also strictly regulated by FCA in the UK, ASIC in Australia, FINTRAC in Canada, and Customs and Excise Department in Hong Kong. In addition, your business’ data is protected behind multiple layers of authentication and encrypted security.

In a nutshell, Airwallex is a global payments company built mainly for all types of businesses, so banking services are not available for sole proprietors. You can entrust your company’s finances to a global account with Airwallex, which will be secured by the highest international standards.

Opening an Airwallex business bank account allows you to have local bank details in the US, UK, Europe, Hong Kong, Japan and Australia. You can also hold funds in multiple currencies to eliminate unnecessary conversions.

Corporations can benefit from free virtual accounts and collective accounts, where it is possible to add team members to help manage the business finances. Airwallex offers a borderless Visa debit card that enables purchasing and paying from anywhere in the world.

In addition, the company supports foreign money transactions in more than 23 currencies at highly competitive fees. Airwallex stands out for offering bank-beating prices in international payments with some of the best exchange rates on the market, up to 90% cheaper than banks.

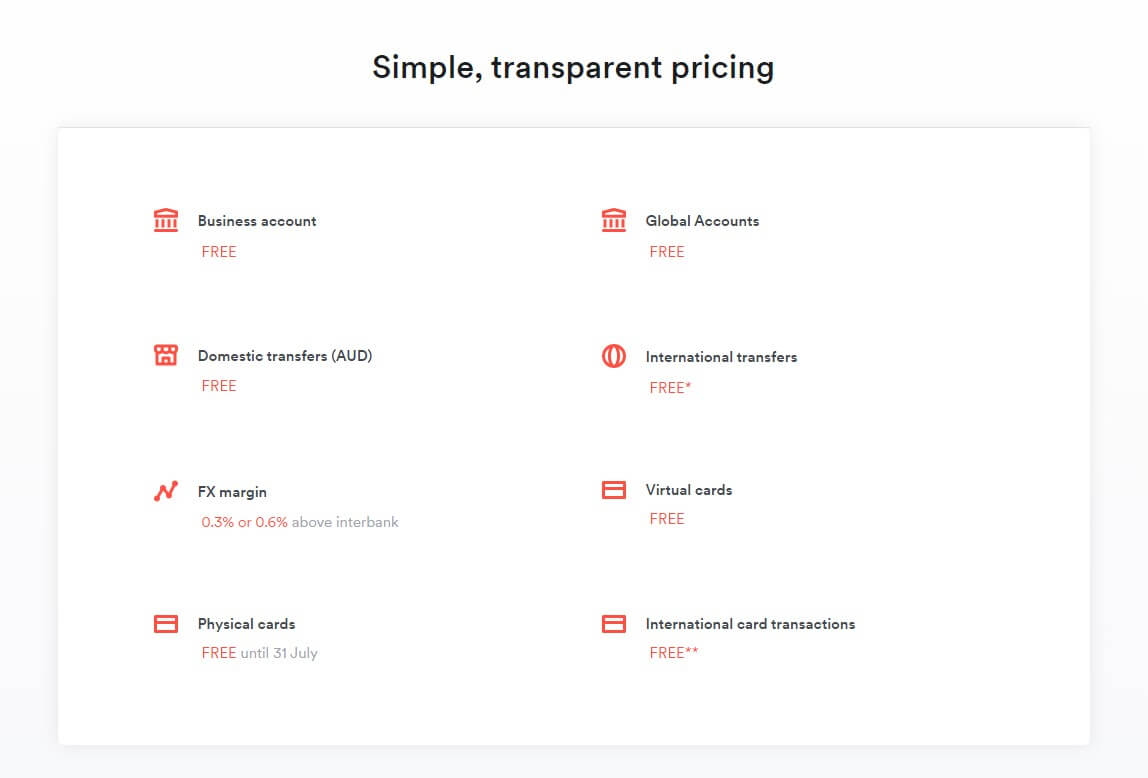

Rates and fees vary by transaction. The company charges a fixed fee based on the payment method and currency, and may also charge conversion rates for foreign transactions (FX), which is a percentage on top of the exchange rates (0.3% - 0.6% above interbank rates).

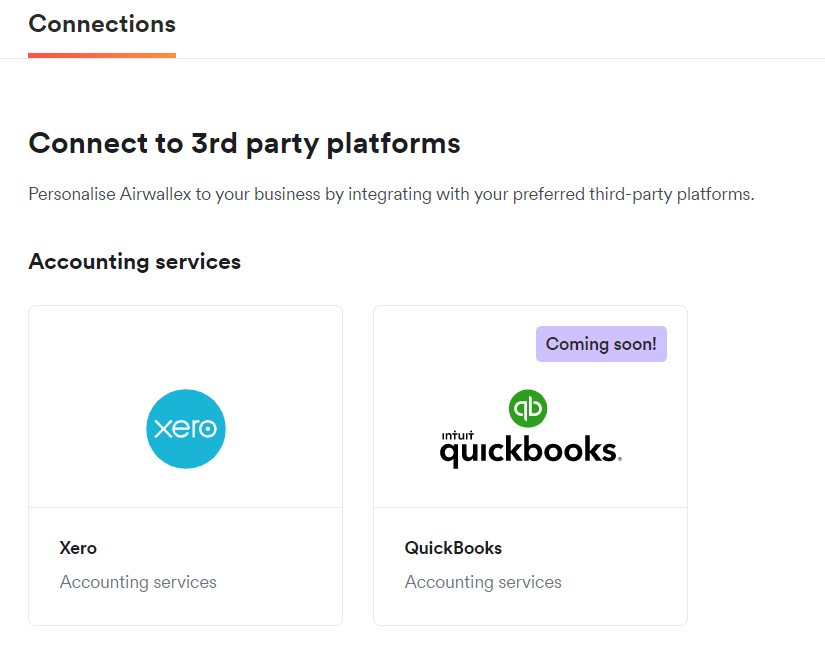

Airwallex smart technology allows businesses to automate payments using API integration. It also supports Xero integration, in order to simplify your bookkeeping by automatically syncing multi-currency transactions in one single platform.

Finally, customers have access to exclusive perks from Airwallex partners, such as apps and tools that help escalate a business, exclusive offers, and easy redemption.

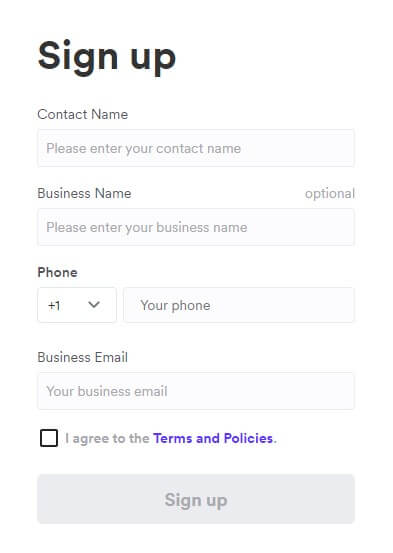

You can sign up for an account in just a few steps and start enjoying Airwallex cross-border payment technology right away. You just need to provide:

Airwallex doesn’t demand a minimum deposit to open a bank account. If you want to explore the payment platform first, you can easily contact the sales team by submitting an enquiry form.

EN, CN

0.3% – 0.6% above interbank fees

$0

Airwallex is ideal for corporations looking to expand into new markets across the globe, especially in Europe, Asia and Oceania. In the US, Airwallex does not yet have a strong presence among local customers.

To get the most out of the US market, businesses can combine Airwallex with Mercury account, which gives both Global and US business bank accounts.

Mercury is a neobank that offers easy USD business accounts, free of bureaucracies, at low rates. By enjoying the benefits of both fintechs, your company will have an effective presence in the world’s largest economy and in other markets worldwide.

John is a recognized world expert in investing. He has tested dozens of investment clubs, communities and investment research services. His research has been featured on Bloomberg, Business Insider, The New York Times, Wall Street Journal, CNet and more.

We are committed to providing honest reviews and advice about neo banks to help you decide which suits your needs the best.

Since 2018, we’ve reviewed 28 neo banks/fintechs and published real user reviews.

2035 Sunset Lake Road Suite B-2 Newark DE 19702

We are committed to providing honest reviews and advice about investment communities to help you decide which suits your needs the best.

Since 2015, we’ve reviewed 28 investment communities and published real user reviews.